Purchase settings correspond to taxes that are automatically applied on products or services purchased by your company. After creating an Other Charge that is a tax, you can define the purchase settings that govern how that tax will apply to purchases.

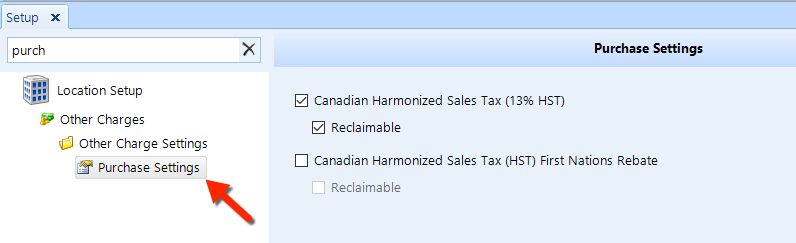

To access the Purchase Settings, follow these steps:

Click on the Setup button in the ribbon, then locate and click on the Purchase Settings item beneath Other Charges Settings item (beneath the Location Setup node) in the left window pane. See the figure below.

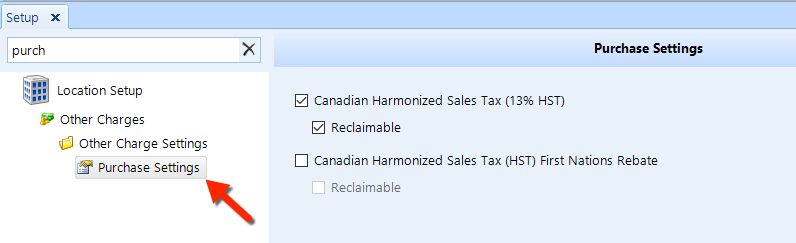

Check the box for each tax that is applicable to purchases.

For each tax, check the reclaimable box if the tax is to be recoverable from the tax authority on your remittance. This is known as an input tax credit.

Click the Save button in the ribbon.